By reps. For the industry.

The pulse of the North American foodservice market. Quarter after quarter, year after year.

Foodservice intel from the sales and marketing experts--MAFSI reps.

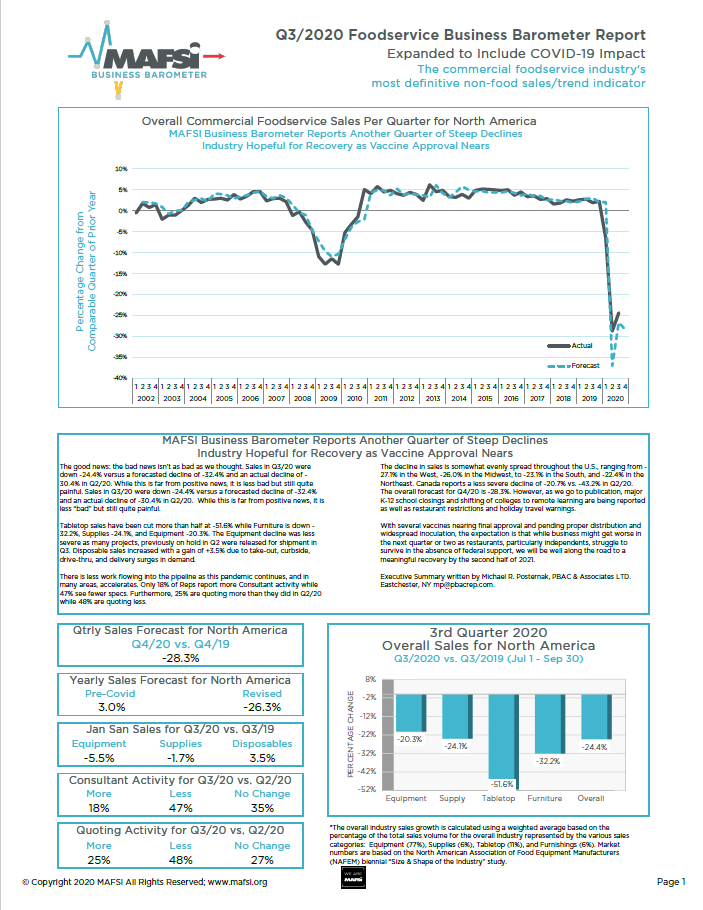

The MAFSI Business Barometer is the leading economic indicator for the 15-billion-dollar foodservice industry.

For 20 years the foodservice industry has relied on the MAFSI Business Barometer for reporting on past performance, current conditions, and future forecasts to help make the most informed business decisions.

Make your decisions on data.

The Barometer breaks down the market both nationally and regionally, into fourteen product categories and equipment sub-categories.

Easily Complete the Business Barometer with MAFSI's New Excel Tool

This tool is just like it sounds, it is an Excel spreadsheet that has been formatted to calculate the percentages needed for your Quarterly Barometer Survey.

Read the blog by MAFSI Board Member, Mike Colligon, High Sabatino Associates

2025 Barometer Release Dates

Q1/2025

4/14/2025 - Survey opens to rep firms

5/15/2025 - Survey released to industry

Q2/2025

7/02/2025 - Survey opens to rep firms

7/24/2025 9/08/2025 - Survey released to industry

Q3/2025

10/02/2025 - Survey opens to rep firms

10/23/2025 11/13/2025 - Survey released to industry

Q4/2025

01/05/2026 - Survey opens to rep firms

02/09/2026 3-5-2026 - Survey released to industry

Are you a Rep Firm and need to complete your barometer survey, but didn't receive your email?

Email us at info@mafsi.org.

Huge thanks to the MAFSI Rep Firms that participated in the Q4 2025 Business Barometer

4 Star Reps, Inc.

AFS Anderson Foodservice Solutions

Agences Hamilton Agencies

Allied Technologies Food Equipment

B Square Enterprises

Beacon Sales Group LLC

Bob Waite & Associates

Burlis-Lawson Group

Celco Inc.

Chrane Foodservice Solutions

Collis Group, Inc.

Copperfield Agencies Limited

DJ Marketing & Associates

Equipment Preference, Inc. (E.P.I.)

Florida Agents, Inc.

Florida REPS, Inc.

Food Equipment Representatives

Gabriel Group LLC

Greenwald Sales & Marketing, LLC

Hollander Company

HRI, Inc.

Kain McArthur

Kaufmann & Associates

KBC Specialty Products, Inc.

Kelly-Mincks

MAC Sales & Marketing LTD.

MarkeTeam Foodservice

MarkeTeam Foodservice West

Mid-West Associates

ONE SOURCE REPS

PB & J Commercial Agents

PBAC & Associates LTD

Pecinka Ferri Associates

Performance Reps Northwest, Inc.

Permul Ltd.

Preferred Marketing Agents, Inc.

Premier Foodservice Group

Premier Foodservice Solutions

Premier Marketing Group, Inc.

Professional Manufacturers Representatives, Inc. (PMR)

Professional Reps

R. Henry & Associates

Schmid-Dewland Associates

Specialty Equipment Sales Company (SESCO)

The Daly & DeRoma Group, Inc.

The Pantano and Pinilla Agency, Inc.

Total Tabletop Plus

Vader & Landgraf, Inc.

Viola Group

Voeller & Associates, Inc.

W. D. Colledge Co., Ltd.

Wyllie Marketing

Zink Foodservice

MAFSI Quarterly Business Barometer Reports

Q3 2014 MAFSI Business Barometer Report

2013-2002 MAFSI Business Barometer Reports

Click + sign next to year to see prior year MAFSI Business Barometer reports.

Want to see the forecast for the year?

Check out the annual MAFSI Foodservice Market Forecast Report.