By reps. For the industry.

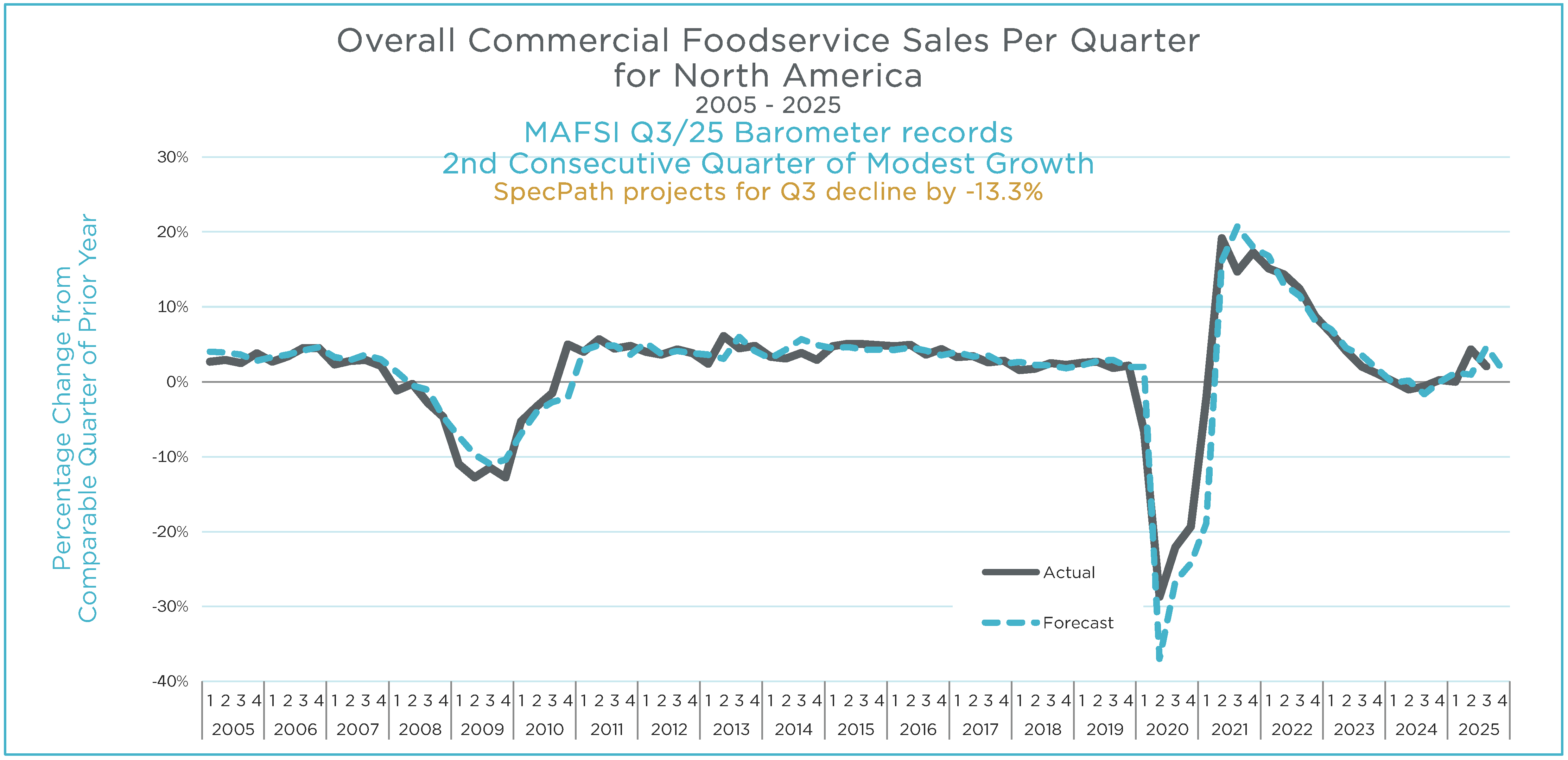

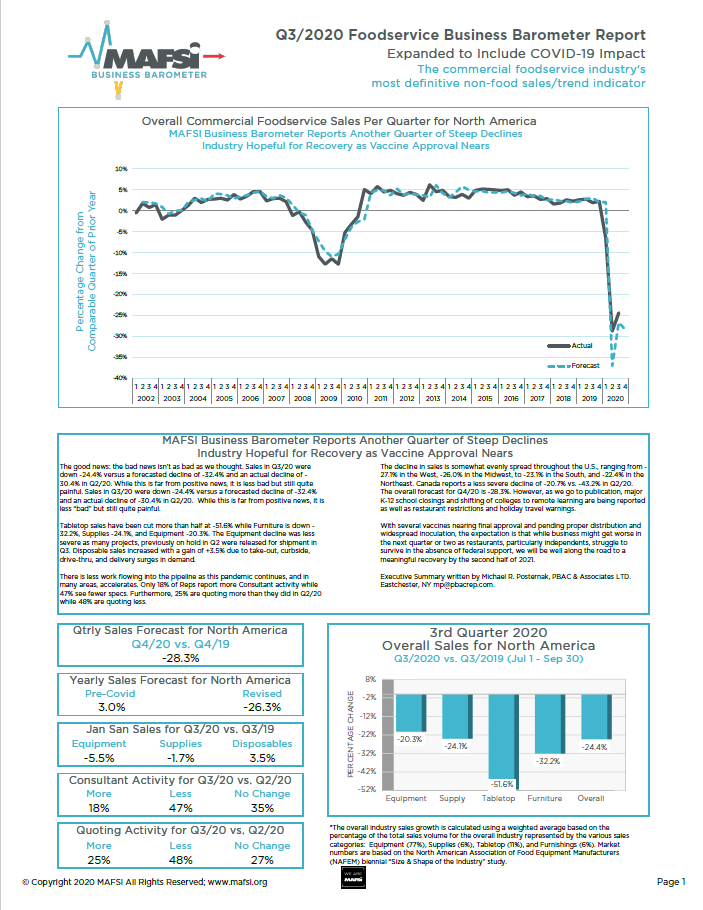

The pulse of the North American foodservice market. Quarter after quarter, year after year.

Foodservice intel from the sales and marketing experts--MAFSI reps.

The MAFSI Business Barometer is the leading economic indicator for the 15-billion-dollar foodservice industry.

For 20 years the foodservice industry has relied on the MAFSI Business Barometer for reporting on past performance, current conditions, and future forecasts to help make the most informed business decisions.

Make your decisions on data.

The Barometer breaks down the market both nationally and regionally, into fourteen product categories and equipment sub-categories.

Easily Complete the Business Barometer with MAFSI's New Excel Tool

This tool is just like it sounds, it is an Excel spreadsheet that has been formatted to calculate the percentages needed for your Quarterly Barometer Survey.

Read the blog by MAFSI Board Member, Mike Colligon, High Sabatino Associates

2025 Barometer Release Dates

Q1/2025

4/14/2025 - Survey opens to rep firms

5/15/2025 - Survey released to industry

Q2/2025

7/02/2025 - Survey opens to rep firms

7/24/2025 9/08/2025 - Survey released to industry

Q3/2025

10/02/2025 - Survey opens to rep firms

10/23/2025 11/13/2025 - Survey released to industry

Q4/2025

01/05/2026 - Survey opens to rep firms

02/09/2026 - Survey released to industry

Are you a Rep Firm and need to complete your barometer survey, but didn't receive your email?

Email us at info@mafsi.org.

Huge thanks to the MAFSI Rep Firms that participated in the Q3 2025 Business Barometer

4 Star Reps, Inc.

AFS Anderson Foodservice Solutions

Agences Hamilton Agencies

Allied Technologies Food Equipment

B Square Enterprises

Bob Waite & Associates

Chernoff Sales, Inc.

Chrane Foodservice Solutions

Collis Group, Inc.

Copperfield Agencies Limited

DJ Marketing & Associates

Elevate Foodservice Group

Equipment Preference, Inc. (E.P.I.)

Food Equipment Representatives

Food Service Solutions Inc.

Greenwald Sales & Marketing, LLC

High Sabatino Associates

Hollander Company

HRI, Inc.

Kain McArthur

Kelly-Mincks

Link2 Hospitality Solutions

MAC Sales & Marketing LTD.

MarkeTeam Foodservice

Mid-West Associates

Midwest Professional Reps, Inc.

ONE SOURCE REPS

P3Reps-NNY/Lake Effect

PB & J Commercial Agents

PBAC & Associates LTD

Performance Reps Northwest, Inc.

Permul Ltd.

Preferred Marketing Agents, Inc.

Pro Reps West - Southern CA Office

Professional Reps

R. Henry & Associates

Schmid-Dewland Associates

Specialty Equipment Sales Company (SESCO)

The Daly & DeRoma Group, Inc.

The Pantano and Pinilla Agency, Inc.

Thormann Associates

Total Tabletop Plus

Tri-State Marketing Associates

Vader & Landgraf, Inc.

Viola Group

Voeller & Associates, Inc.

W. D. Colledge Co., Ltd.

Walter Zebrowski Associates

Zink Foodservice

MAFSI Quarterly Business Barometer Reports

Q3 2014 MAFSI Business Barometer Report

2013-2002 MAFSI Business Barometer Reports

Click + sign next to year to see prior year MAFSI Business Barometer reports.

Want to see the forecast for the year?

Check out the annual MAFSI Foodservice Market Forecast Report.